Export Bill Discounting

Description

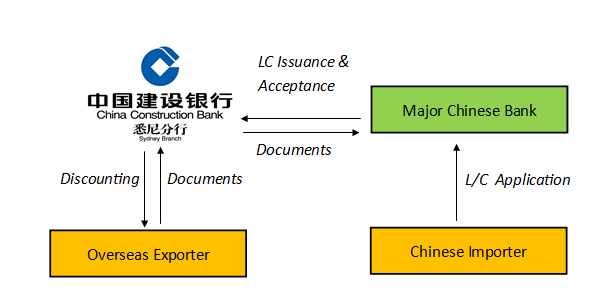

Export Bills Discounting is a facility offered by CCB Sydney to local clients to finance their export trade transactions. Financing period is usually between 30 to 365 days.

Upon receiving a Letter of Credit, CCB Sydney will advise this LC to the exporter. The exporter presents documents to CCB Sydney and once the issuing bank accepts the documents, CCB Sydney will discount the bill. CCB Sydney can also provide discounting with DF.

Structure

Advantages

Exporters needn’t wait until issuing bank’s payment at maturity. CCB Sydney could discount the export bills, so that the exporters will be paid immediately upon shipment.

● No client credit line required;

● Improve the exporter’s cash flow;

●The discounting with DF can assist exporter to settle trade in CNY but get payment in USD (or other major currencies).